This is because variable costing will only include the extra costs of producing the next incremental unit of a product. The adoption of absorption costing has direct implications for a company’s tax liabilities. Tax authorities typically require that inventory costs include both fixed and variable production costs, which aligns with the principles of absorption costing.

What Is Absorbed Cost?

Since this method is widely used by many manufacturing companies, it is necessary yo know the advantages and disadvantages of the same. The assignment of costs to cost pools is comprised of a standard set of accounts that are always included in cost pools, and which should rarely be changed. In practice, if your costing method is using Absorption Costing, you are expected to have over and under absorption. Once you complete the allocation of these costs, you will know where to put these costs in the Income Statements. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Absorption Costing in Financial Reporting

This method ensures that all costs of production are captured in the cost of inventory, leading to a more comprehensive understanding of product profitability. However, the allocation of fixed costs can sometimes result in fluctuations in unit costs when production levels vary from the norm, which can affect the comparability of financial results over different periods. In the manufacturing sector, absorption costing is particularly relevant due to the significant role of fixed costs in production. Manufacturers often incur substantial fixed costs in the form of machinery, plant maintenance, and labor contracts. By applying absorption costing, these fixed costs are spread over the units produced, which can smooth out the cost per unit over time, especially in industries with seasonal production cycles or fluctuating demand.

Step 1. Assign Costs to Cost Pools

In addition to skewing a profit and loss statement, this can potentially mislead both company management and investors. Absorbed cost calculations produce a higher net income figure than variable cost calculations because more expenses are accounted for in unsold products, which reduces actual expenses reported. Also, net income increases as more items are produced, because fixed costs are spread across all units manufactured. This characteristic of ledger restaurant and bar can lead to differences in reported profits compared to variable costing, especially when there are changes in production levels and inventory levels. Both the above methods are accounting techniques that companies use to allocate the cost of production over the total number of units produced.

Absorption costing, also known as full costing, is a method that accounts for all manufacturing costs, both fixed and variable, in the cost of a product. It is a comprehensive approach that can significantly impact the financial statements of a company. Understanding its key principles is essential for interpreting its effects on business operations and financial outcomes.

- Absorption costing fails to provide as good an analysis of cost and volume as variable costing.

- We will use the UNITS SOLDon the income statement (and not units produced) to determinesales, cost of goods sold and any other variable period costs.

- This allocation is often based on time spent or resources used, which can help in setting prices that ensure all costs are covered.

- The application of absorption costing extends across various sectors, each with its unique characteristics and cost structures.

- This method of full absorption costing becomes very important is there is the need to follow the accounting principles for external reporting purposes.

- Explore the fundamentals and implications of absorption costing for various industries, its role in financial reporting, and the surrounding debates.

Furthermore, it takes into account all of the costs of production (including fixed costs), not just the direct costs, and more accurately tracks profit during an accounting period. Direct costs are those costs that can be directly traced to a specific product or service. These costs include raw materials, labor, and any other direct expenses that are incurred in the production process. Despite its widespread use and compliance with accounting standards, absorption costing is not without its detractors. One of the primary critiques is that it can potentially distort a company’s financial performance, particularly in the short term.

Examples include costs related to electricity, water, and supplies used in the manufacturing process. The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead costs). As 8,000 widgets were sold, the total cost of goods sold is $56,000 ($7 total cost per unit × 8,000 widgets sold). The ending inventory will include $14,000 worth of widgets ($7 total cost per unit × 2,000 widgets still in ending inventory). Indirect costs are those costs that cannot be directly traced to a specific product or service. These costs are also known as overhead expenses and include things like utilities, rent, and insurance.

It is also used to calculate the profit margin on each unit of product and to determine the selling price of the product. Absorption costing takes into account all of the costs of production, not just the direct costs as is the case with variable costing. Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills. Having a more complete picture of cost per unit for a product line can help company management evaluate profitability and determine prices for products.

As companies build up their inventory, a portion of the fixed costs is capitalized on the balance sheet rather than expensed on the income statement. This capitalization results in a lower taxable income in the current period, as the recognition of these costs is postponed until the sale of the inventory. Consequently, companies may experience a temporary reduction in their tax burden, which can be strategically significant, especially for businesses in capital-intensive industries where large inventories are common. Absorption costing has some limitations, and it can be challenging to assess the impact of changes in production levels on profitability since fixed overhead costs remain constant. Since absorption costing requires the allocation of what may be a considerable amount of overhead costs to products, a large proportion of a product’s costs may not be directly traceable to the product.

In addition, it is not helpful for analysis designed to improve operational and financial efficiency, or for comparing product lines. Absorption costing stands as a cornerstone in the field of accounting, pivotal for its role in financial reporting and strategic decision-making. This method’s significance is underscored by its widespread application across various industries and its influence on tax calculations.

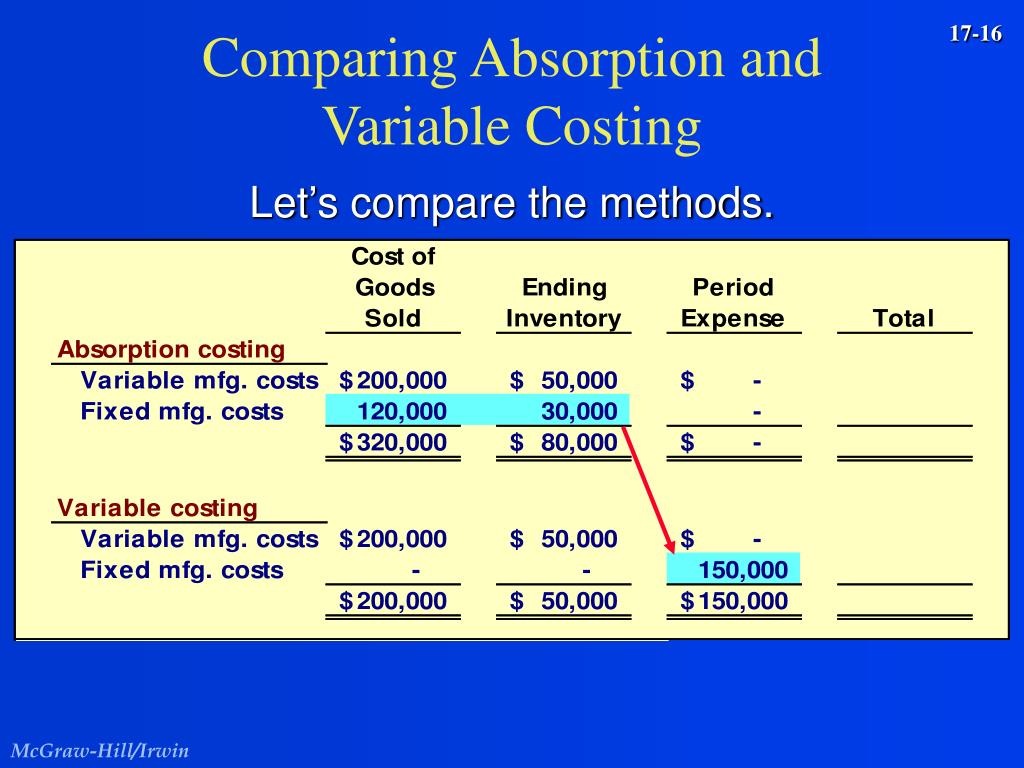

It is sometimes called the full costing method because it includes all costs to get a cost unit. Another method of costing (known as direct costing or variable costing) does not assign the fixed manufacturing overhead costs to products. Therefore, direct costing is not acceptable for external financial and income tax accounting, but it can be valuable for managing the company. Absorption costing is a method of costing that includes all manufacturing costs, both fixed and variable, in the cost of a product. Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively.