This means that companies can reduce or eliminate slow-moving or obsolete inventory, which in turn reduces the cost and time needed to dispose of these items. An efficient operational process can also help reduce other costs like marketing, finance, etc. The operating cycle is important for measuring the financial health of a company. Sourcetable, an AI-powered spreadsheet, revolutionizes complex financial calculations, including the operating cycle calculation. With features tailored to streamline and simplify data analysis, Sourcetable enables users to perform precise calculations effortlessly.

Formula

The Net operating cycle, also known as the cash conversion cycle, takes into account both the time required to convert assets into cash and the time taken to pay suppliers. It combines the time for inventory turnover and receivables collection minus the payables period. A smart technique to assess a company’s financial health is to follow an operational cycle over time.

- Issues like production delays, excess stock, or lenient credit terms can all contribute to a longer cycle, affecting cash flow.

- It reflects not just on liquidity but also a company’s agility in managing resources, which can be pivotal for strategic decision-making and competitive advantage.

- Sourcetable, an AI-powered spreadsheet, transforms complex data analysis into a seamless and efficient process.

- In today’s competitive job market, both job seekers and employers face numerous challenges.

- HighRadius provides a powerful, cloud-based Order to Cash solution designed to automate and streamline your financial operations.

- Together these figures form the operating cycle length – revealing how quickly a business can convert its products into cash through sales and collection efforts.

- When evaluating potential employers, candidates can inquire about the company’s operating cycle to gain insights into its financial stability and efficiency.

Does a shorter or longer operating cycle indicate better performance?

It can also aid in determining its efficiency and how smoothly activities run. This article will explain what an operating cycle is and why it is important, as well as how to calculate it using the formula, suggestions and examples. To accurately calculate the operating cycle of a company, specific financial information and formulas are required. The operating cycle, a critical financial metric, measures the time between purchasing inventory and receiving cash from sales. By implementing these strategies, businesses can enhance their operating cycles, increase efficiency, and strengthen financial health. It is essential for organizations to adapt to changing market dynamics and continuously optimize their operations to stay competitive and resilient in today’s challenging business environment.

EQUIPMENT BILL OF SALE: Form Templates (+Free Printable Forms)

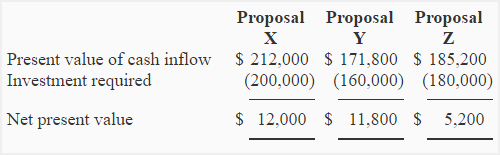

If a company has a short operating cycle, it indicates that the firm can quickly convert its inventory into sales and then into cash. A related concept is that of net operating cycle which is also called the cash conversion cycle. The net operating cycle subtracts the days a company takes in paying its suppliers from the sum of days inventories outstanding and days sales outstanding. Assume Bob operates a bakery and is attempting to determine how well his business is performing.

Understanding the Operating Cycle: Definition, Formula, and Calculation Methods

While the industry norms provide a benchmark, each company should calibrate its operating cycle to bookkeeping its unique realities and trade-offs. On the downside, a short cycle could mean the company is losing out on opportunities to use credit terms for its benefit. It might also mean the firm is not maintaining enough inventory to meet the potential surge in demand.

Do you own a business?

As there are numerous impacts on a company’s operating cycle, there are numerous ways in which an operating cycle can aid in determining a company’s financial status. The better a business owner knows the company’s operating cycle, the better decisions that owner may make for the benefit of the business. Effective inventory management is critical for streamlining the operating cycle.

How to improve the operating cycle?

In parallel to receiving payments from customers, companies also have to manage accounts payable. This involves paying suppliers for raw materials or services received, ensuring a continuous flow of resources for operations. After the products or services are ready, the next step is sales and accounts receivable.

- This insight can help the company make informed decisions to streamline operations and improve cash flow management.

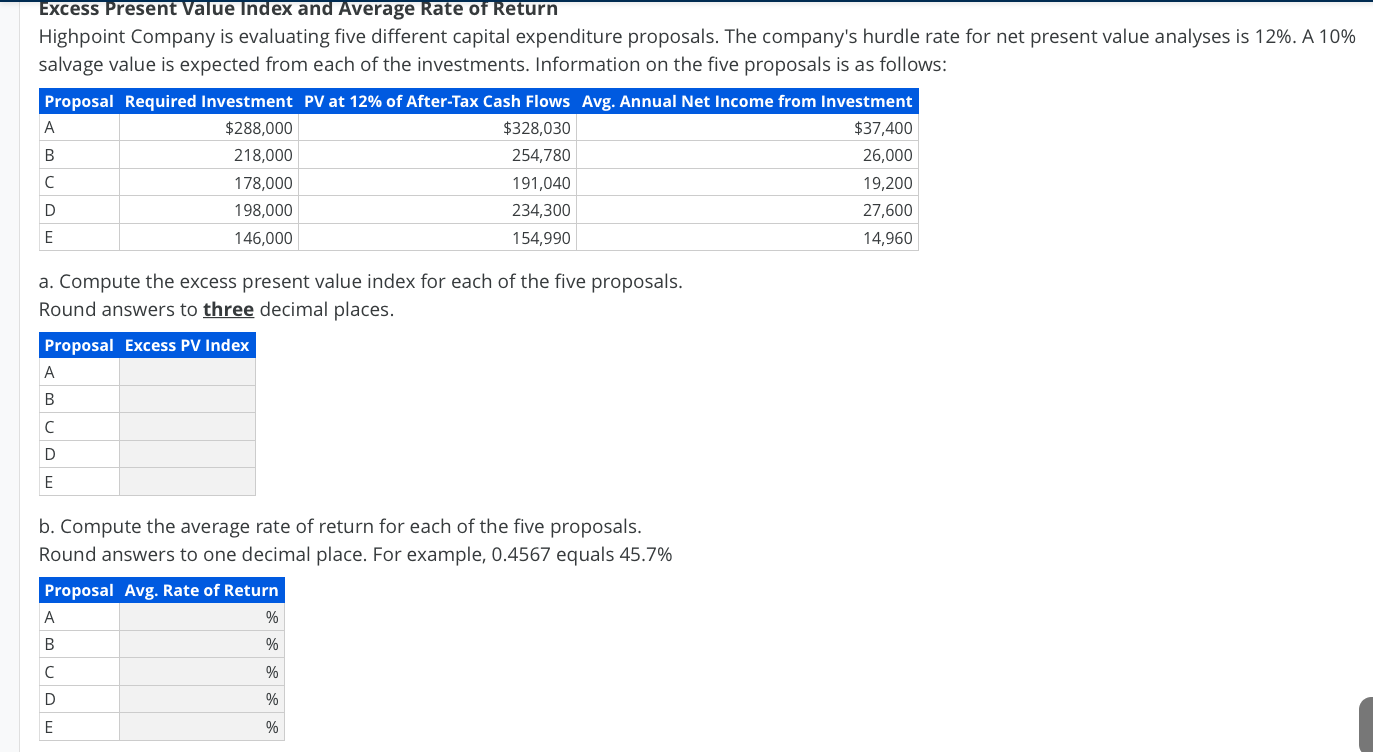

- Below, we discuss three practical examples illustrating how to calculate this pivotal financial metric.

- One of the best examples of a company with the ideal operational efficiency is Toyota.

- An operating cycle is one more valuable tool in the toolkit of financial analysis that helps businesses make wiser, more informed decisions.

The resulting figure represents the number of days in the company’s operating cycle. The companies with high operational efficiency are typically those that provide goods or services with short shelf lives i.e., clothing, electronics, etc. Accounts Receivable Period is equal to the number of days it takes to receive Bookstime payment for goods and services sold.

- Tracking and operating cycles over time is a fantastic method to see how a business is doing financially.

- For example, the net accounts receivable turnover is used to determine how often customers must pay for their product before they can make another purchase.

- This is useful in estimating the Cash cycle in a working capital requirement for maintaining or growing an organization’s operations.

- Efficient management of an operating cycle is crucial for the sustainable growth and success of any business.

- The operating cycle provides insights into a company’s liquidity and efficiency.

- In contrast, an operating cycle assesses the effectiveness of the operations, yet they are both beneficial and offer essential knowledge.

- An increased operating cycle can result from slower inventory turnover, longer times to collect payments from customers, or delays in paying suppliers.

Related Resources

Companies how to find operating cycle need to market their offerings, attract customers, make sales, and ensure timely payment collection to keep the cycle running smoothly. The operating cycle formula is a great addition to insights you may want to analyze for your business frequently. This can keep you updated on the efficiency of your inventory process, which provides insights time and again to help you reduce wastage and improve your overall processes. On the other hand, if a company has the longest cycle, it means that it takes a long time to convert its inventory purchases into cash.