If we change the composition of the basket, then the composite contribution margin would change even though contribution margin of the individual items would not change. Let’s look at an additional example and see how we find the break-even point for this weighted average basket. Break-even analysis for multiple products is made possible by calculating weighted average contribution margins. In computing for the multi-product break-even point, the weighted average unit contribution margin and weighted average contribution margin ratio are used. Let’s look at an additional example and see how we find the break-even point for a composite good. Using a forecasted or estimated contribution margin income statement, let’s verify that the break even sales in units at Soul Sisters is correct.

Margins in the Sales Mix

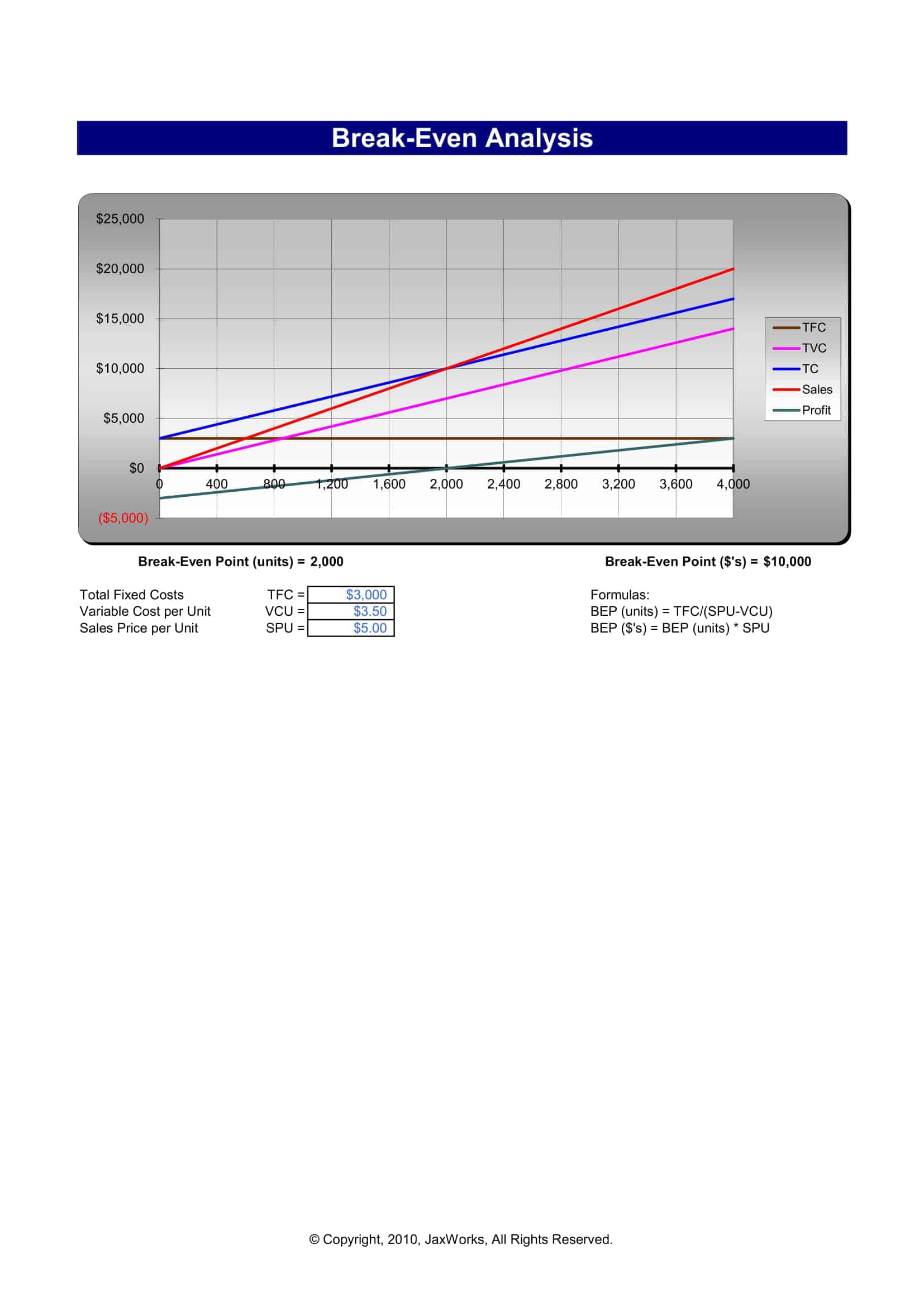

By following the step-by-step approach outlined in this essay, businesses can make informed decisions about pricing, production, and sales strategies to achieve profitability. The break-even point in units is equal to total fixed costs divided by the weighted average contribution margin per unit (WACMU). This assumption allows us to calculate a weighted average contribution per unit or as a dependent 2020 batch and/or CS ratio which can be used to solve Break-even, margin of safety and target profit problems. The concept of a break-even chart is similar to a cost behavior chart, but with sales revenue shown as well. If the chart also indicates the budgeted volume of sales, the margin of safety can be shown as the difference between the budgeted volume and the break-even volume of sales.

Perform break-even sensitivity analysis for a multi-product environment

Businesses can maximise their profits if they are able to achieve a sales mix that is heavy with high-margin products, goods, or services. If a company focuses on a sales mix heavy with low-margin items, overall profitability will often suffer. This analysis is crucial for understanding the profitability of a product mix and helps businesses make informed decisions regarding pricing, production levels, and resource allocation. It takes into account the sales mix, contribution margin of each product, and the overall financial goals of the organization.

Calculate the price of your order

The break even units are calculated as before except this time we use the weighted average contribution margin. The following dataset contains information on per-unit sales, per-unit variable expenses, and the expected sale ratio of 3 products, along with the company’s fixed expenses per month. The amount remaining from sales revenue after variable costs have been deducted, indicating how much revenue contributes to covering fixed costs.

Step 7: Compute the Contribution Margin

This information is used in computing weighted average selling price and weighted average variable expenses. In order to perform a break-even analysis for a company that sells multiple products or provides multiple services, it is important to understand the concept of a sales mix. Sales mix is important to business owners and managers because they seek to have a mix that maximises profit, since not all products have the same profit margin.

- In this formula, I have subtracted the total variable expense from the sales at the break-even point.

- It should be noted that as the business can’t sell a part of a product, the number of units is always rounded up.

- If we know we need $125,000 in sales to breakeven but the sales mix is different from what we budgeted, thenumbers will appear quite different (as you should have noticed inthe video).

- For the sake of clarity, we will also assume that all costs are companywide costs, and each product contributes toward covering these companywide costs.

- If a company focuses on a sales mix heavy with low-margin items, overall profitability will often suffer.

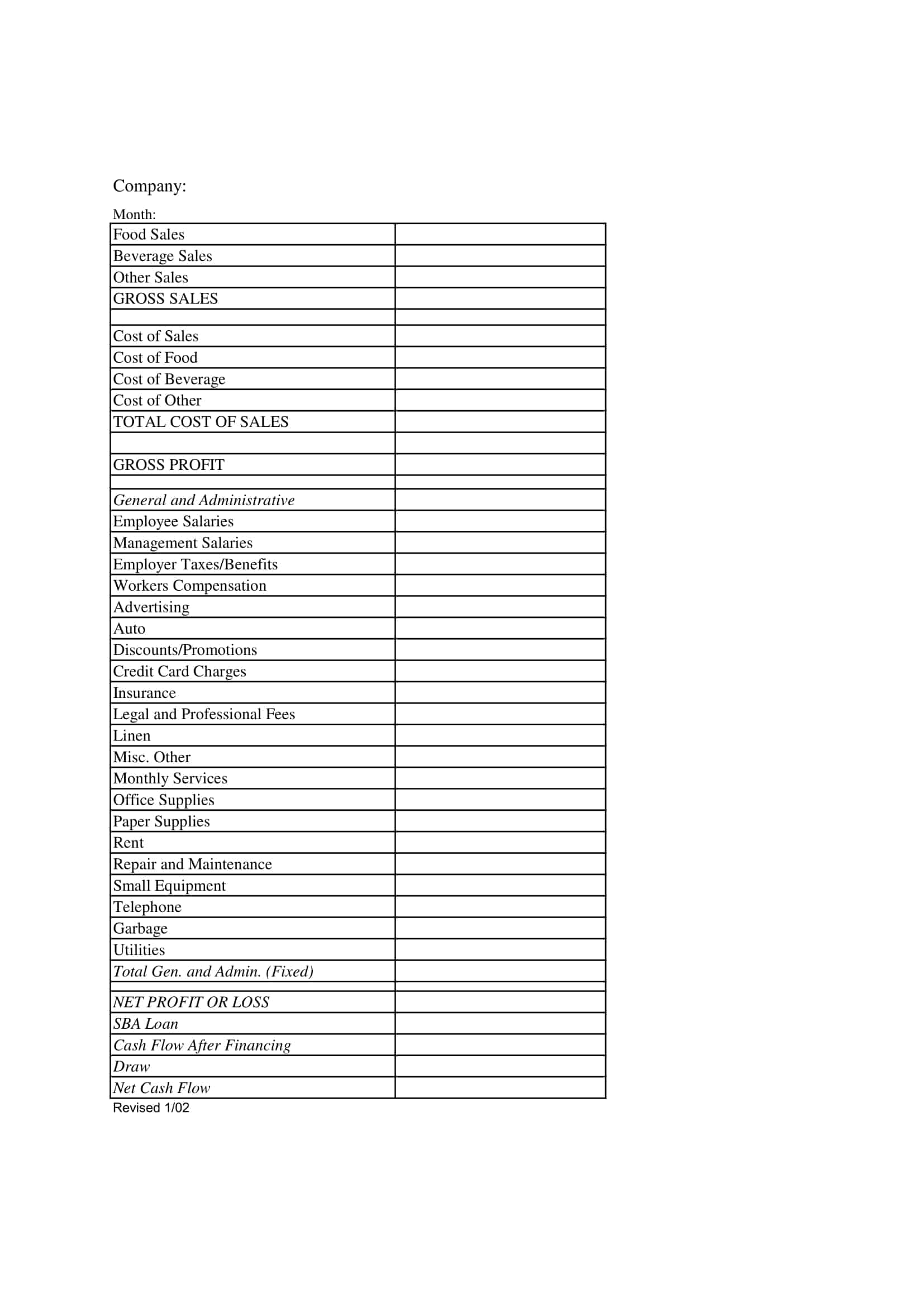

Company

In this formula, I have multiplied the sales per unit by the total target units. The proportion of different products sold by a company, affecting the overall profitability and break-even calculations. However, most businesses sell more than one product, and the calculation of the break even units needs to be amended to reflect this.

Fixed costs remain constant regardless of the volume of products sold (e.g., rent, salaries). In this formula, I have subtracted the total variable expense from the sales at the break-even point. Costs that do not change with the level of production or sales, such as rent, salaries, and insurance. Plan Projections is here to provide you with free online information to help you learn and understand business plan financial projections. It should be noted that as the business can’t sell a part of a product, the number of units is always rounded up.

I have multiplied the break-even point by the expected sale ratio in this formula. ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems. As you can see, the net operating income is zero, so you can say that the break-even analysis is correct. Our tutors are highly skilled in researching and writing quality content that is relevant to the paper instructions and presented professionally.

Soul Sisters can use this CVP analysis for a wide range of business decisions and for planning purposes. Remember, however, that if the sales mix changes from its current ratio, then the break-even point will change. For planning purposes, Soul Sisters can change the sales mix, sales price, or variable cost of one or more of the products in the composite unit and perform a “what-if” analysis. It should be noted that this method of break even analysis for multiple products only works when the product sales mix remains constant. When preparing financial projections an estimate of the sales mix will be used and a break even position can be calculated. If as time passes the actual results reveal a different sales mix, then the financial projections would be revised and a new break even position must be determined using a revised sales mix calculation.

Calculating the break-even on a company with only one product is relatively easy. Just take the total fixed expenses and divide by the contribution margin per unit. The contribution margin per unit is the unit sales price minus the unit variable cost.