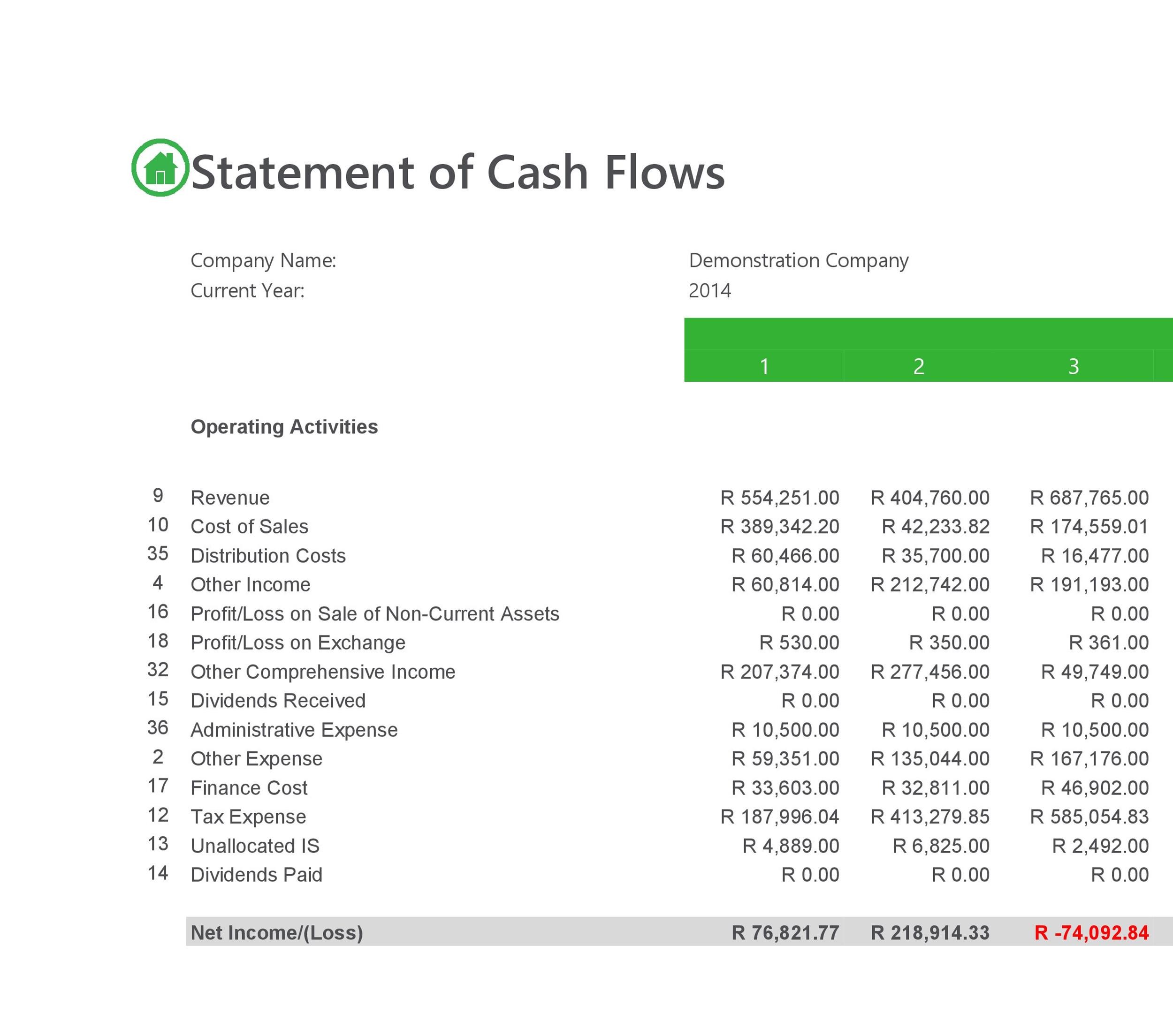

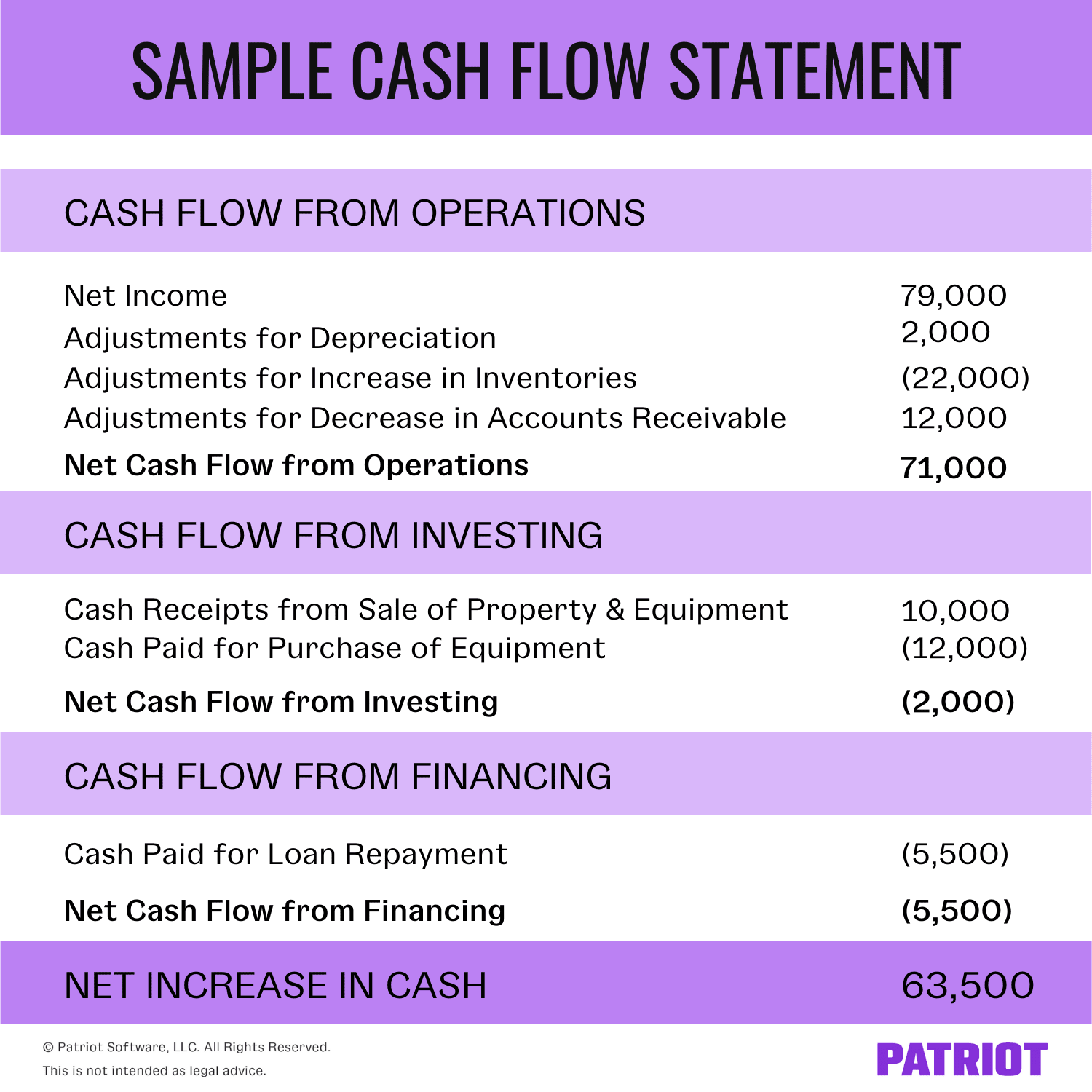

It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from. Specifics about each of these three transactions are provided in the following sections. Details relating to the treatment of each of these transactions are provided in the following sections.

Get Your Questions Answered and Book a Free Call if Necessary

The following sections discuss specifics regarding preparation of these two nonoperating sections, as well as notations about disclosure of long-term noncash investing and/or financing activities. Changes in the various long-term assets, long-term liabilities, and equity can be determined from analysis of the company’s comparative balance sheet, which lists the current period and previous period balances for all assets and liabilities. Cash flows from investing activities always relate to long-term asset transactions and may involve increases or decreases in cash relating to these transactions. The most common of these activities involve purchase or sale of property, plant, and equipment, but other activities, such as those involving investment assets and notes receivable, also represent cash flows from investing. Changes in long-term assets for the period can be identified in the Noncurrent Assets section of the company’s comparative balance sheet, combined with any related gain or loss that is included on the income statement.

How confident are you in your long term financial plan?

- To reconcile net income to cash flow from operating activities, add increases in current liabilities.

- However, this could also mean that a company is investing or expanding which requires it to spend some of its funds.

- All of these adjustments are totaled to adjust the net income for the period to match the cash provided by operating activities.

- The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing.

- If the summary number is negative, more cash was paid out than was received for that activity during the period.

Another important function of the cash flow statement is that it helps a business maintain an optimum cash balance. This section covers cash transactions from all of a business’ operational activities, such as receipts from sales of goods and services, wage payments to employees, payments to suppliers, interest payments, and tax payments. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks. The following comparative balance sheets are for Dells Corporation as of 2010 June 30, and 2009 June 30. Also provided is the statement of income and retained earnings for the year ended 2010 June 30, with additional data.

Cash flow statement indirect method

The payable arises, or increases, when an expense is recorded but the balance due is not paid at that time. An increase in salaries payable therefore reflects the fact that salaries expenses on the income statement are greater than the cash outgo relating to that expense. This means that net cash flow from operating is greater than the reported net income, regarding this cost. Propensity Company had a decrease of $4,500 in accounts receivable during the period, which normally results only when customers pay the balance, they owe the company at a faster rate than they charge new account balances.

Transactions that do not affect cash but do affect long-term assets, long-term debt, and/or equity are disclosed, either as a notation at the bottom of the statement of cash flow, or in the notes to the financial statements. The statement of cash flows is based on information from the income statement, retained earnings statement, and balance sheet. The underlying principles in ASC 230 (statement of cash flows) seem straightforward. Cash flows are classified as either operating, financing or investing activities depending on their nature.

Prepare the Operating Activities Section of the Statement of Cash Flows Using the Indirect Method

And for practical issues where the guidance remains unclear, we offer our views on how to classify many of these cash flows. Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit. The cash flow statement will not present the net income of a company for the accounting period as it does not include non-cash items which are considered by the income statement.

Then prepare a partial statement of cash flows – direct method, showing only the cash flows from operating activities section. The operating activities section is the only difference between the direct and indirect methods. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows.

The $171,000 debit entry in the debit column is the cost of the equipment that was purchased on September 12. The sale results in a cash inflow, and the purchase results in a cash outflow. Each investing activity transaction is listed on its own line on the statement of cash flows. Cash inflows are listed first and each begins with “Cash received from…” Cash outflows follow and each begins with “Cash paid for…” If there is more than one inflow, they are subtotaled in the middle column. The statement of cash flows is a central component of an entity’s financial statements. Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash.

One was an increase of $700 in prepaid insurance, and the other was an increase of $2,500 in inventory. In both cases, the increases can be explained as additional cash that was spent, but which was not reflected in the expenses reported on the income statement. In the above example, the business has net cash of $50,049 from its operating activities and $11,821 from its investing activities.

If a fixed asset’s balance increases from one year to the next, it means that more must have been purchased and there was a cash outflow. Similarly, if a fixed asset’s balance decreases from one year to the next, it means that some or all of it was sold and there was a cash inflow. To help determine the amount of cash received accounting definition of self balancing accounts or paid, refer to the journal entry for each transaction to see if Cash was debited or credited. The main components of a cash flow statement are cash flows from operating activities, investing activities, and financing activities. Prepare a working paper to convert net income from an accrual basis to a cash basis.

These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.